Which of the Statements About Subprime Lending Is False

When foreclosures became widespread. Recognizing that the interagency Subprime Statement does not apply to subprime loan originations of independent mortgage lenders and mortgage brokers on June 29 2007 the Conference of State Bank Supervisors CSBS the American Association of Residential Mortgage Regulators AARMR and the National Association of Consumer Credit Administrators.

The risks associated with subprime lending increase as the likelihood of falling home prices increase.

. Subprime lending also commonly referred to as BC or nonconforming credit refers to the extension of credit to persons who are considered to be higher-risk borrowers usually due to their impaired credit histories. This Statement reiterates many of the principles addressed in existing guidance relating to prudent risk management practices and consumer protection laws. The total change in the m1 brought about by the money multiplier is affected by the amount of deposits made by homes and businesses.

Storgan Manley increases its profitability by borrowing money to invest. Answer true or false to the following. Subprime lending is not synonymous with predatory lending and loans with the features described above are not necessarily predatory in nature.

Subprime borrowers generally have low credit ratings or are people who are. However institutions should ensure that they do not engage in the types of predatory lending practices discussed in the Expanded Subprime Guidance. In addition to an expansion in the number of loans the Commissions testimony notes that the composition of the industry is changing.

One of the most dramatic changes has been the growth in subprime mortgage lending by large corporations that operate nationwide. Subprime lending is not synonymous with predatory lending and loans with the features described above are not necessarily predatory in nature. In 1997 alone subprime lenders originated over 125 billion in home equity loans.

Storgan Manley is a large financial institution. The fedfederal reserve has very little effect on the money multiplier. Which of the statements about sub prime lending is false.

All the other statements are true. Do Subprime loans dont include flexible-rate loan Ie ARMs that adjust beyond the borrowers ability to pay TF False. This statement applies to all.

For further information contact Credit Market Risk 202 649-6670. The Commissions complaint alleges among other things that New Centurys second and third quarter 2006 Forms 10-Q and two late 2006 private stock offerings contained false and misleading statements regarding its subprime mortgage business. This statement complements the agencies existing guidance on subprime lending programs OCC Bulletins 1999-10 and 2001-6 and the 1993 Interagency Guidelines for Real Estate Lending.

The federal financial regulatory agencies today issued a final Statement on Subprime Mortgage Lending to address issues relating to certain adjustable-rate mortgage ARM products that can cause payment shock. Who receives higher fees on Subprime loans. Conduct such as falsifying information on a mortgage application for example.

If a home owner is unable to afford the mortgage payments the homeowner can always pay off the mortgage by selling the home. If a home owner is unable to afford the mortgage payments the homeowner can always pay off the mortgage by selling the home. Economics questions and answers.

Before the 2008 financial crisis financial institutions increased the number of subprime loans they issued as home prices continued to rise. When borrowers increase their maximum allowable loan by accepting a shorter term and a. Banks must lend out all their reserves in order to change the m1 money supply 3.

Fraud on the part of lenders was a factor that contributed to the subprime mortgage crisis of 2008. Subprime loans have interest rates that are higher than the prime rate. Option 3 is the false statement because Canada has a smaller market share of subprime mortgages than the US.

The statements regarding savings and loans SLs are all true EXCEPT. SLs are not covered by federal deposit insurance. A Boston mortgage broker was charged yesterday with using forged bank statements and tax returns and other false documents to help unqualified home buyers secure subprime loans.

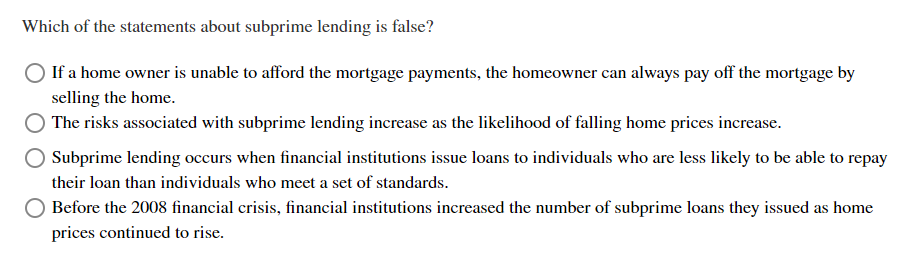

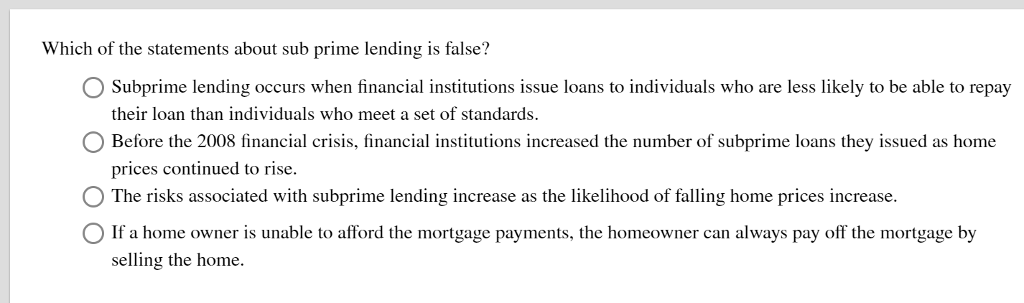

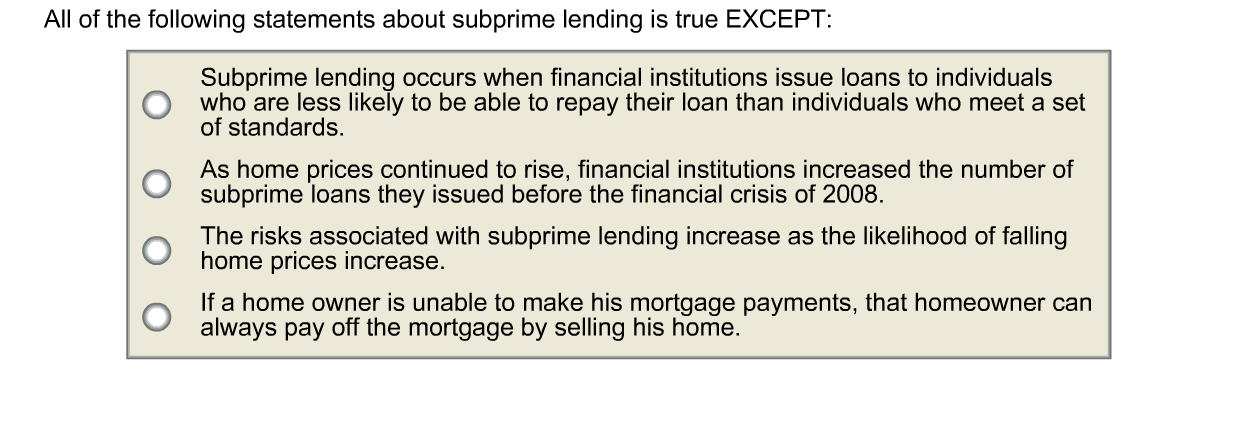

Which of the statements about subprime lending is false. Subprime loans and prime loans are _____ together and sold to _____ on the secondary market. Which of the statements about subprime lending is false.

Which of the statements about subprime lending is false. On June 29 2007 the Federal Reserve and the other federal financial institutions regulatory agencies the agencies issued the attached final Statement on Subprime Mortgage Lending Subprime Statement to address issues and questions related to certain adjustable-rate mortgage ARM products marketed to subprime borrowers. The statement describes the prudent safety and soundness and consumer protection standards that institutions should follow to ensure.

In 2003 subprime lenders originated 332 billion in mortgage loans6 compared to. O Subprime lending occurs when financial institutions issue loans to individuals who are less likely to be able to repay their loan than individuals who meet a set of standards O Before the 2008 financial crisis financial institutions increased the number of subprime loans they issued as. In recent years subprime mortgage lending has grown dramatically.

Solved Which Of The Statements About Subprime Lending Is Chegg Com

Solved Which Of The Statements About Sub Prime Lending Is Chegg Com

Solved All Of The Following Statements About Subprime Chegg Com

No comments for "Which of the Statements About Subprime Lending Is False"

Post a Comment